U.S. Insurers failing to deliver on digital customer experience

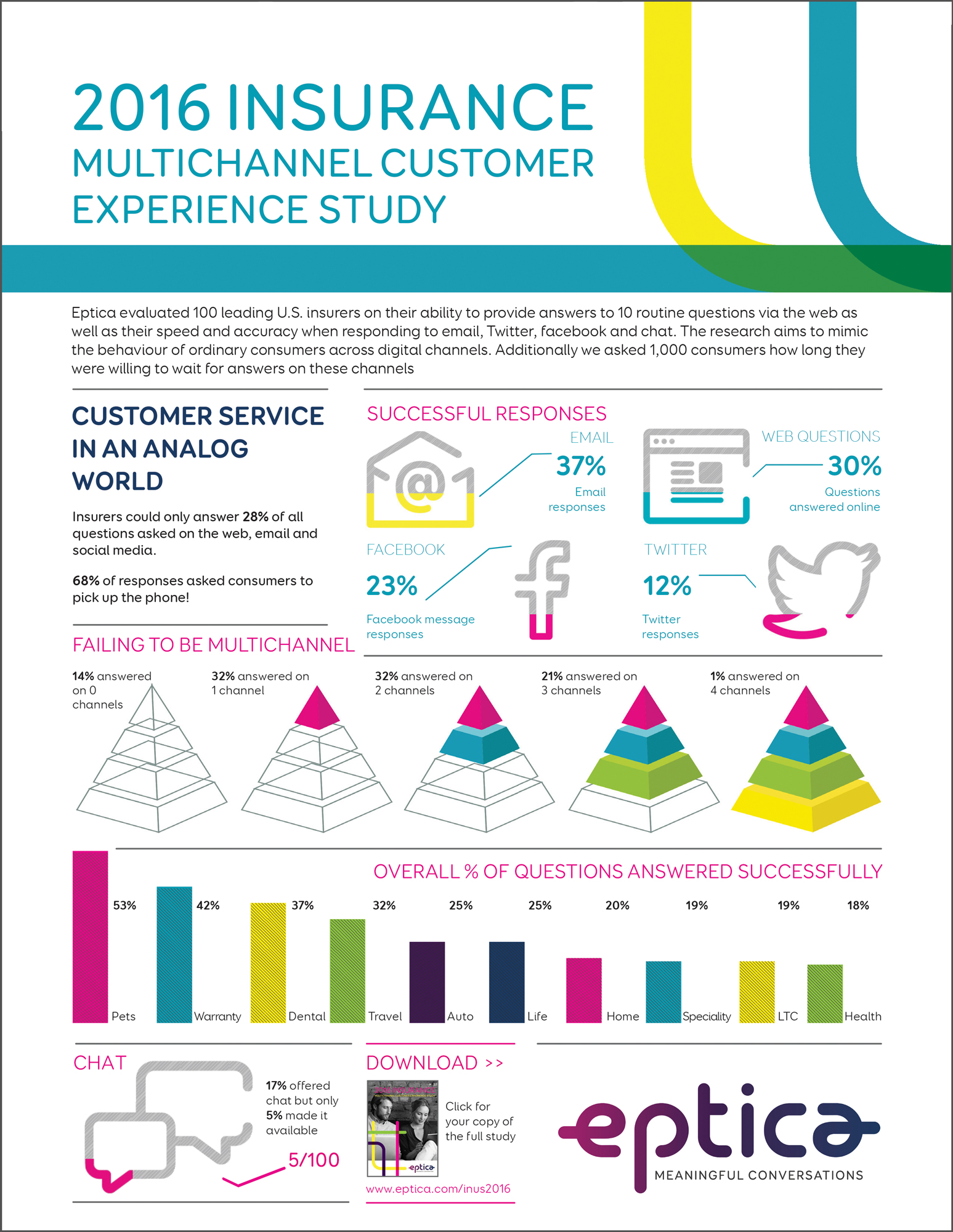

Leading companies only able to answer 28% of queries via web, email and social media

BOSTON - Mass, October 6, 2016 – Despite the growth of digital channels, insurers seem to be stuck in an analog world, unable to respond accurately, quickly or consistently to customer queries asked via the web, email, Twitter, Facebook or chat, according to new research from multichannel customer engagement software provider Eptica.

BOSTON - Mass, October 6, 2016 – Despite the growth of digital channels, insurers seem to be stuck in an analog world, unable to respond accurately, quickly or consistently to customer queries asked via the web, email, Twitter, Facebook or chat, according to new research from multichannel customer engagement software provider Eptica.

Insurers could only answer 28% of queries across digital channels, and 14% of companies failed to respond successfully on either email, social media or chat. While email was the strongest channel for answers, with a 37% success rate, the average time to receive a response was nearly two days (1 day 23 hours 38 minutes).

These are the topline findings of the 2016 Eptica Insurance Multichannel Customer Experience Study, which evaluated 100 leading U.S. insurers, spread across ten sectors, on their ability to provide answers to routine questions via email, the web, chat, Facebook and Twitter. Additionally, 1,000 consumers were polled on how long they were willing to wait for responses on these channels.

The Study measured the ability of insurers to provide answers to 10 routine questions via the web, as well as their speed and accuracy when responding to email, Twitter, Facebook and chat. Questions were deliberately similar to those that consumers ask, such as around purchasing or administering policies online, discounts for multiple products and when cover would start.

As well as 37% of emails, insurers provided answers to 30% of questions on their websites, 23% in response to Facebook messages and 12% to tweeted queries. There were big differences between particular sectors – pet insurers answered 57% of questions online, compared to 15.5% amongst long term care providers. One dental insurer responded to an email in 13 minutes – yet another took over 6 days to answer the same question.

“The insurance industry is at a crossroads, with the rise of digital disrupting traditional ways of doing business,” said Olivier Njamfa, CEO and Co-founder of Eptica. “To succeed in this new world insurers need to prioritize the digital customer experience, yet the Eptica study shows that they are struggling to adapt and move away from analog channels. Digital doesn’t just benefit consumers, but also drives greater efficiency and enables innovation – it is therefore time for insurers to learn from their peers in other industries and apply best practice to their operations to meet changing customer needs.”

The research found that insurers are out of step with consumer expectations. While over half of consumers (57%) expect a response on Twitter within half an hour, just 26% of insurers met this deadline, with the majority of replies then not answering the queries. 61% of consumers complained that they could not find information on company websites half the time they looked for it.

>On social media speed varied wildly. One long term care insurer successfully responded to a tweet in under 2 minutes, while 13 companies answered on Facebook within 5 minutes. Yet at the other end of the spectrum 20 insurers took over 6 hours to respond on social media, with three taking a day or more. There was little consistency between different channels, showing that many are taking a silo based approach to customer service that pushes up costs and slows down service.

Additional key findings included:

- 68% of responses on email, Twitter and Facebook asked the researcher to change channel and call, even for the most basic queries

- 47% of insurers failed to provide consistent answers between different channels

- Just one company replied on all four channels of email, Facebook, Twitter and chat

- 17% of insurers claimed to offer chat, yet only 5% had it operational when they were evaluated

- Nearly half (46%) of consumers said they’d spend just 5 minutes searching for information on a company website before giving up and going elsewhere

- U.S. performance trails the U.K., where insurers answered 54% of all questions, 80% asked via email and 45% via the web.

Eptica Insurance Multichannel Customer Experience Study methodology

In total 100 company websites across 10 different insurance sectors were evaluated in September 2016:

- For their ability to answer ten basic, sector-specific questions via their website, such as Can I purchase my policy online or How can I cancel my policy?

- On the speed and accuracy of their response via the email, Twitter, Facebook, and chat channels.

- nbsp;On the consistency of responses across the web, email, Twitter, Facebook and chat.

Consomer research on channel expectations was conducted by Toluna with 1,000 American insurance buyers in September 2016.

The full 2016 Eptica Insurance Multichannel Customer Experience Study, which includes a full listing of companies evaluated, a detailed sector by sector breakdown of performance and full analysis, can be downloaded from http://www.eptica.com/insurance-multichannel-customer-experience-study.

An infographic illustrating the results is available from:

PDF:http://www.eptica.com/infographic-insurance-multichannel-cx

JPG: http://www.eptica.com/infographic-2016-insurance-eptica-multichannel-cx